When a small business is having difficulty maintaining day-to-day cash flow due to their client’s long payment duration or past due payments, they may need to come up with an alternative, stop-gap solution. Selling unpaid invoices to another company is often used as a quick, low-stress option used many industries.

In this article, we will share the insights we have garnered over the past 25 years here at CapitalPlus. Having provided thousands of small businesses with factoring, we will guide you through everything you need to determine if invoice factoring is the right fit for your business.

Contents:

• What is Invoice Factoring and How Does It Work?

• Advantages of Invoice Factoring

• Common Types of Factoring

• Invoice Factoring vs. Other Funding Options

• Misconceptions About Invoice Factoring

• Is Invoice Factoring Legal?

• What to Know When Assessing Factoring Companies

—— factoring fees/costs, reputation, specialization, funding limits, customer service, recourse/non-recourse

• Invoice Factoring Requirements and Eligibility

• The Invoice Factoring Steps and Timeline

• Tips for Getting the Most Out of Factoring

• Real-World Factoring Examples

• Is Invoice Factoring Right for You? A Checklist

Introduction to Invoice Factoring

Utilized across various industries like construction, trucking, and staffing, Factoring is used to temporarily bridge day-to-day cash shortfalls while waiting on client payments. Factoring is used when other financial alternatives, like bank loans or merchant cash advances, don’t make financial sense for the business.

There are approximately 682 factoring companies in operation in the US according to a 2022 Capstone report. The latest IBISWorld report states that factoring employed 5,374 individuals supplying an estimated $3.85 trillion in 2023. These solid numbers, and future projections, indicate that factoring is likely to stay a staple in the financial industry for years to come.

What is Invoice Factoring? How Does It Work?

In simple terms, a business sells its yet-to-be-paid invoices to a factoring company or “Factor”. The factoring company will pay, or “advance” them a percentage of that invoice amount upfront. Depending on the industry the advance would be anywhere between 70% to 85%, but could go as high as the mid-90s for trucking or staffing industries.

After the invoice is paid by the client, the factoring company will return the remaining percent to the company, less its factoring fee and any other possible fees.

Factoring example based on a $50,000 invoice:

| The Invoice Amount | terms:* | $50,000 |

| Initial (Advance) Payment Amount | 80% advance rate | $40,000 |

| Invoice Factoring Fee | 4% flat rate | $2,000 |

| Additional Fees* | $500 application fee | $500 |

| Returned Remainder | after client payment (30 to 90 days) | $7,500 |

* This example uses a typical factoring fee percentage; however, each factoring company will have its own factoring fees and/or rates, and possibly additional fees (see “other fees“).

Advantages of Invoice Factoring

In the right situation, there are many advantages for a company to use factoring:

Fast Access to Working Capital

Speed is often the #1 reason companies partner with factoring companies. Compared to the time it takes to get a bank loan (assuming you can even be approved for it), receiving money by factoring invoices can take as little as one business day after the account is created. Invoice factoring allows you to continue to build without being handcuffed by your clients’ slow payments.

>> RELATED ARTICLE: How to Speed Up the Construction Factoring Application Process

Use Factoring Funds for What’s Needed

Quick access to working capital allows you, the contractor, to not just pay off previous projects but have funds that can be used for:

- pay reoccurring overhead such as rent, utilities, lease payments, payroll

- pay external contractors

- purchase materials and supplies

- invest in growth-inducing areas such as marketing and advertising

- hire employees or staff-up for upcoming projects

- expand operational capacity or improve efficiency with new computers/software, tools/equipment, and other upgrades

Keep Your Extended Payment Terms

Another benefit of invoice factoring is it allows companies who are experiencing cash flow issues to continue to bid on jobs that have 30 to 90-day payment terms, just like they would during times when they are not experiencing cash flow issues. The factoring company will ensure that you are paid quickly for those invoices since they will be the ones who wait to receive payments from the client. This allows you to compete with other businesses and not ignore projects with extended payment terms.

Ease of Qualifying

It can be a difficult and lengthy process to qualify for many business financing solutions like lines of credit from banks, especially if you are in construction. But factoring has a relatively simple qualifying process. Most companies are able to easily contract with a factoring company if their invoices reflect they have already worked with creditable clients.

Part of the complexity of trying to get a bank loan will be providing the mountains of paperwork. While there will be paperwork needs associated with factoring, when you apply, you probably WON’T need to supply this exhaustive list often required by banks.

Typical Bank Loan Paperwork:

- A loan application

- The project’s details

- Contractor’s qualifications

- Financial statements

- The invoice contracts

- Insurance documentation

- Personal and business documents

In addition to all this paperwork, there is the added time that the bank takes to assess everything and make their decision.

While obtaining bank loans is generally more difficult, there are also things that make obtaining factoring difficult. A factoring company will not like certain types of liens, large numbers of other financial obligations, or legal issues with your business. If you are free of those, you should be able to receive factoring without issue.

The Invoices Are the Collateral

Loans and lines of credit often require substantial collateral. Factoring, however, only uses your invoices as collateral. This means you can keep your materials, equipment, and other assets separate.

Small or New Companies Can Factor Invoices

A traditional bank loan can be hard to get if you are not a large, well-established entity. However, factoring supports these smaller companies in maintaining cash flow, even if they have slow-paying clients. The decision-makers approve factoring based on your client’s credit history… factoring gets you money based on their history. This means that if you don’t yet have established credit or even have less-than-perfect credit, invoice factoring can be a powerful solution for smaller companies looking to pay bills and grow their business.

Disadvantages of Factoring

Of course, factoring is not a perfect solution for every situation. When talking about the disadvantages of this financing option, higher fees are mentioned most often. They are usually higher than those of banks (but less than Merchant Cash Advances) and there are often additional fees or costs. Of course, these fees are not standard across all factoring companies so it is always best to get clarity in advance.

Another disadvantage that can arise when factoring is the changing of the relationship between you and your customer. After you choose to use factoring, the factoring company will be talking to your customer directly. If not communicated in advance that this will happen, it can lead to an (unnecessary) awkward discussion.

>> IN-DEPTH ARTICLE: The Pros and Cons of Factoring

Common Types of Factoring

Spot Factoring

Spot factoring is a subset of common invoice factoring. Rather than purchasing a certain number (or all) of your invoices, spot factoring allows the contractor to pick one or a few specific invoices that will be purchased by the factoring company. While spot factoring does offer tailored benefits over traditional factoring, it can be slightly more difficult to obtain.

Whole Turnover Factoring

Whole turnover factoring is a type of factoring arrangement where a contractor sells all their invoices over an extended time period, unlike traditional factoring which works more like a stop-gap solution. It encompasses the company’s entire accounts receivable portfolio of business. Whole turnover factoring provides consistent and continuous financing but can be difficult to obtain and costly.

Government Contract Factoring

As the name implies, this offshoot of factoring involves the selling of a government-issued invoice. Working with our government can have its unique challenges such as navigating the Assignment of Claims Act which requires special knowledge that not all factoring companies have. The overall process of applying for government contract factoring is very similar to other forms of factoring.

Reverse Factoring

Reverse factoring is very similar to traditional factoring with the only difference being who sells and who pays. With traditional factoring, a business would sell an invoice to a factoring company and use the funds to pay, for example, for a materials order. With reverse factoring, the materials supplier sells their own invoices (at a discount) to the factoring company. After a predetermined time or at job completion, the buyer pays the factoring company for the materials. The factoring company acts as a middleman getting paid for extending payment terms.

Factoring process:

- business orders materials

- business requests factoring

- business receives factoring funds

- business uses factoring to pay for the materials

- business pays the factoring company after project completion

Reverse Factoring process:

- business needs materials

- supplier requests factoring

- supplier receives payment (factoring funds) for the materials

- business pays a factoring company for the materials after project completion

Since there are multiple agreements by all parties and pre-approval checks, reverse factoring can be more involved to set up in the beginning.

Comparing Invoice Factoring with Other Funding Options

Factoring vs. Bank Loans

Factoring differs from bank loans in that it provides immediate access to funds based on the value of outstanding invoices, whereas bank loans require collateral and a lengthy application process. Factoring focuses on the creditworthiness of the business’s customers, whereas bank loans primarily consider the creditworthiness of the business itself. The trade-off is that factoring is typically more expensive than bank loans.

>> RELATED ARTICLE: What to Expect When Getting A Bank Loan in Construction

Factoring vs. Lines of Credit

A line of credit gives businesses a set amount of money they can borrow when needed. Like bank loans, “LOCs” will have a much longer, more difficult application process, but offer more flexibility for businesses to access funds when and if required. And they typically have lower rates than factoring.

Invoice Factoring vs. Merchant Cash Advances (MCA)

Invoice factoring differs from merchant cash advances in that factoring works from the sale of an actual unpaid invoice, whereas merchant cash advances provide a lump sum loan payment based on a percentage of your past credit card sales. An MCA will look at these numbers and decide what you should be able to pay. Their interest rates can vary widely between companies. They are repaid by pulling a percentage of weekly or even daily sales directly from the company’s bank account. For the struggling company, this can be difficult for those with already limited or erratic cash flow.

Invoice Factoring vs. Invoice Financing

Unlike invoice factoring where the business sells unpaid invoices upfront to a third party, invoice financing is where the business borrows money from a lender using its unpaid invoices as collateral. In this case, the lender will make its money by charging interest on the loan, which will vary depending on the lender and the creditworthiness of the business. And because invoice financing is a specialized loan, if there are any problems, penalties will be added.

The business may choose invoice financing over factoring if it wants to retain ownership of its invoices and can afford to wait for the payments to come in. A con of invoice financing is the business is still in charge of collecting the invoices and making payments, unlike factoring where the factor collects their payment.

>> IN-DEPTH ARTICLE: 19 Financing Options Available to Construction Businesses

Common Misconceptions of Invoice Factoring

To the person who has not factored invoices before, it is easy to believe stories that may or may not be based on real situations. These misconceptions are ones typically heard when discussing factoring.

Factoring is Only Used When in Financial Trouble

Some believe that factoring may give the impression that your company is experiencing financial troubles. However, invoice factoring can be a strategic financial tool used by many profitable businesses, including construction companies, to proactively manage their cash flow. It can demonstrate a commitment to meeting financial obligations promptly. Factoring can actually enhance a company’s reputation as a reliable and financially stable business.

Factoring Creates Complications with Existing Financing

Some companies may believe that factoring can create complications with their existing financing arrangements. However, factoring is a separate financing solution that does not typically interfere with existing business loans or lines of credit. Factoring companies primarily evaluate the creditworthiness of the company’s customers rather than the company itself. This means that they can still maintain their current financing relationships while benefiting from the additional working capital provided by factoring.

Factoring Hurts the Customer Relationships

It is not unheard of to believe that factoring puts a strain on a company’s customer relationships again implying financial troubles. However, factoring is a common and widely accepted practice in business. The factoring company typically operates discreetly, and customers are usually fine working with a third-party factor in the transaction.

>> RELATED ARTICLE: Top 6 and 1/2 Myths About Factoring Companies

Is Invoice Factoring Legal?

Yes, invoice factoring is legal, fully recognized under the law, and widely used in various industries, including the construction sector. As long as all parties involved agree to the terms and conditions of the factoring arrangement, it is a legal and viable method for supplementing cash flow and addressing short-term financial needs. However, it is essential to thoroughly understand the terms of the factoring agreement, know the fees involved, and work with reputable factoring companies to ensure that everything is fair and beneficial to both you and the factoring company.

What to Know When Assessing Invoice Factoring Companies

There are many aspects that need to be considered when picking the best factoring company for your unique situation. However, we have listed a few of the common things to look for when doing a quick assessment.

1. The Invoice Factoring Fees, Rates, and Other Costs

Like funding’s dollar amounts, invoice factoring fees vary depending on many options. Such aspects that have an effect on rates are the size of the company needing financing, the creditworthiness of its customers, the number of invoices being factored, how long they commit to working with the factoring company, whether they repeat customers, and other specific terms outlined in the factoring agreement. While individual rates may vary across industries, a typical invoice factoring fee range for the construction industry is around 2% to 5% of the total invoice value.

Other Fees and Charges:

Often included with the standard invoice factoring fee(s) there may also be additional costs. It’s essential to review and understand all fees involved before entering into the agreement.

Fees that you might see when working with a factoring company:

- Setup/Due Diligence/Origination/Underwriting fee: You might be charged a one-time fee when you start the service. These fees are used to pay for some of the initial assessments of you and your clients. Some companies assess this in the form of a refundable deposit.

- Minimum Volume Requirement fees: a fee for when invoices fall below certain amounts.

- Wire transfer fee: Charged by some companies if the client pays by wire transfer. It might also be charged if you want to receive your payment in this form.

- Returned check fee: You might be assessed this fee if your client bounces the payment check.

- Interest fee: A fee for when waiting for invoices to be paid. This may be assessed as a one-time fee, or accumulated weekly/monthly.

- Lockbox fee: For the security of all involved, factoring companies will often set up lock boxes for receiving payments. This fee covers the cost.

- Late payment fee: Charged if a client pays their invoice after the agreed-upon due date.

- Cancellation/Early Termination fee: Charged when ending the contract early with the factoring company.

- “Customer Service” and other fees: miscellaneous fees going by various names that a company might assess. Because these fees can be nondescript it is important to first, know that they exist, and second, be clear about what is involved upfront.

Because there is no industry standard, is important to understand that you might be assessed some, all, or none of these fees as part of your factoring arrangement. When working with reputable factoring companies your specific fee structure will be discussed in the initial phone call and outlined in your factoring agreement. None of these fees should ever be surprise “hidden fees”.

2. The Factoring Company’s Reputation

With so many choices in the factoring world, it can be difficult to choose a good one. How do you know they are reputable? They are often members of trade associations and educational groups like the Construction Financial Management Association or the International Factoring Association. Trusted factoring companies will often receive positive reviews and testimonials on Google or at the Better Business Bureau. Of course, you can always ask other people in your industry. They are usually happy to share their experiences – both good and bad.

3. Industry Specialization of the Factor

When researching factoring companies there will be many to pick from. Some support multiple industries, while others choose to focus on unique businesses such as trucking or construction. When considering whether to work with a specialized factoring company, it’s important to weigh the specific needs and goals of your business. You should choose a factoring partner that aligns with those requirements offering the expertise necessary to support your success in the industry.

One advantage of working with factoring companies that specialize is they will be familiar with the unique world of that industry’s clients and their debtors. They understand the typical payment practices of that industry and can accurately assess the creditworthiness of those debtors. This knowledge helps them make informed decisions about which invoices to finance, reducing the risk of non-payment.

Additionally, factoring companies that specialize in, for example, the construction industry, often have an established network and connections within the industry. This synergy could open doors to potential customers, recommend subcontractors, and other industry professionals. They may also have relationships with other service providers such as insurance brokers and construction attorneys. They will even work with other factoring companies, meaning that if the factoring company is not a good fit, the factor will be able to refer to another that is.

4. The Factor’s Funding Limits

As a general guideline, the funding limit range in construction, for example, typically falls between $100,000 and several million dollars. Larger companies with established track records and strong financials may be able to secure higher funding limits. It’s important to note that the funding limit is determined on a case-by-case basis and is subject to the factoring company’s assessment and the risk associated with its invoices.

5. Their Customer Service and Support

One of the significant advantages of utilizing an industry-specific factoring company is the level of customer service and communication they provide. Unlike larger companies or banks where it can be challenging to connect with a real person over the phone, working with a smaller factoring company increases the likelihood of prompt assistance from someone familiar with your business and situation. This eliminates the frustration of navigating through automated phone systems and dealing with representatives who are unfamiliar with your industry. By choosing a smaller company, you can enjoy the convenience of connecting with a person you have worked with before… who knows you by name.

Another benefit is that specialized factoring companies might offer industry-specific support services. They can assist with lien management, offer notice of assignment (NOA) services, and provide guidance on navigating construction regulations.

6. Recourse vs. Non-Recourse Factoring Agreement

When you decide that factoring is right for your business, another aspect to be clear about is whether the factoring is recourse or non-recourse. This aspect of factoring refers to who is ultimately liable if the payment is not received. With recourse factoring, also known as “full factoring”, the business selling the invoices retains the ultimate responsibility for payment. With non-recourse factoring, the factoring company assumes all the credit risk for non-payment by the debtor. If the debtor fails to pay, the loss is absorbed by the factoring company, relieving the business of any obligation to repurchase the invoice.

If a Factor does not advertise that they are recourse or non-recourse factoring, they more than likely offer recourse factoring since that is the safest option for them. It is worth noting that non-recourse factoring will typically come with higher rates to try to offset the risk.

The Invoice Factoring Company’s Requirements and Eligibility

Because of the unique nature of factoring, the requirements can be unique compared to other funding choices. Most requirements are designed to protect not only themselves but also the company they are helping. Every factoring company has its own list so ask questions before committing.

Your General Operations Paperwork

As a general protection, factoring companies will often ask for basic business documents. It goes without saying, giving money to a business that cannot provide a copy of a business license or show proof of insurance is reckless.

Indicators of Your Business’s “Health”

A Factor may want to see documents that help them get an idea of the company’s historic business practices, such as taking work and not completing it. The Factor does not want the client to refuse to pay the invoice because the terms of the job were never completed. Examples of requested paperwork might be P&Ls or balance sheets. Keep in mind that the factoring company is not looking for spotless financials. They want to get a general overview of the past difficulty the business has endured and how it was dealt with.

Your Current Contractual Obligations

Knowing how the company has worked, both in the present and in the future, is a big determinant for making the decision whether to or not extend factoring money. It indicates both a company’s ability to complete work and not have upcoming financial issues due to lack of work.

One financial area a Factor looks for is other current loans or financial obligations. It is not unusual to work with companies that take out loans to pay other ones. But it is a problem when it is obvious that the company is overextended to the point that it will never be able to pay everyone back.

It might sound strange, but a Factor might also ask about your company’s ownership. They want to be sure the key players involved know about the factoring agreement. It is not unheard of to have one owner trying to hide financials from another owner. Having the signature of both helps ensure communication by all.

Your Company’s Minimum Invoice Amounts

As with all businesses, there are costs involved in running a factoring company. And because they usually work off percentages, factoring a low-dollar-amount invoice may not return enough income to offset the labor costs required to service the account. As a result, Factors have minimum requirements on the invoices they will consider. Some smaller factoring companies may be more willing to work with lower invoice amounts like $5,000 to $10,000. Larger, more established factoring companies may need larger invoices, including those in the $50,000 to $100,000 range or even higher.

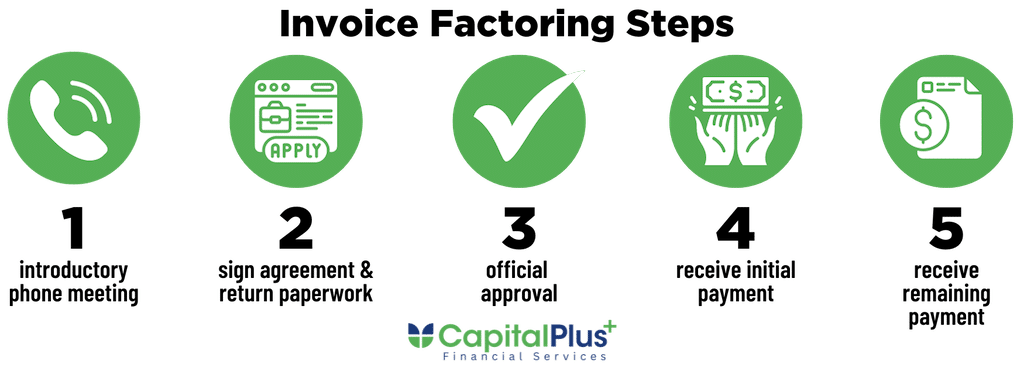

The Invoice Factoring Steps and Timeline

While there is not one standard application process that every company uses, applying for factoring does not usually have many steps. And with simplicity and fewer steps, there is usually quicker funding.

1. Phone Meeting – Understanding Your Business

Requesting factoring here at CapitalPlus typically starts with an introductory phone call. We will ask a few simple questions about your business. For example, we like to know your billing cycle, and if you have other loans (and the types they are). This helps us determine if invoice factoring will help you and if different factoring options might be a better option for your needs. We do NOT want to recommend a service that is not a perfect fit – we are looking to build a long-term relationship. At this point, you will have a clear idea of all the factoring costs and a general timeline.

2. Official Agreement and Factoring Underwriting Paperwork

When every question is answered and everyone is confident that invoice factoring is a perfect fit, we will send you an application to become a client and a term sheet formally outlining all the details discussed in the phone meeting like your factoring fees and terms.

After we receive your application, we will request a few documents as part of our underwriting process. An example of documents we need is your business license, proof that you have insurance, and a copy of the invoice(s) being factored for example.

3. Application Approval

Our factoring underwriting department will take over from here. If all documents meet their standards, you will be notified that you are now an “official” client.

We will then send your client a factoring Notice of Assignment (NOA) letting them know about your new relationship with CapitalPlus and that we will be in contact with them. We will also request a copy of the invoice(s) from the client showing the invoice amounts to verify that all numbers match what was submitted before.

4. Payment Funding

After all the above information has been checked and signed off, you will receive the initial payment. Depending on whether you are bonded or not, the amount is 70% to 80% of the invoice’s face value.

5. Collection and Payment

Once your client pays the invoice and contacts us letting us know the job is complete to their standards, we will send you the remaining 20 to 30% less our factoring fee. Of course, you will know this exact factoring fee after the initial discovery phone call and agreement paperwork.

Please note that this process may not exactly match the process of all factoring companies. It is the process we have built in the 25+ years we have been offering this service.

Tips for Getting the Most Out of Invoice Factoring

Communicate with Your Clients Early

Because a Factor will be working directly with your client, it’s best to make them aware of the new relationship. Most of the time they have no problem with the arrangement, but being surprised can unnerve them. So clear and early communication is key.

Consider Using Factoring Strategically

While it is most typical to use factoring after cash flow gets tight, do not ignore the idea that factoring can be used proactively. It might make more financial sense to use factoring and take projects with high profit than turn away work simply because invoice factoring has fees. Knowing every cost upfront, including using factoring as a strategy allows you to weigh choices that make your company the most money.

Reevaluate Previous Factoring Rates and Agreements

Factoring companies will do all they can to find solutions to best fit your situation… at that time. But you should not discount factoring as a funding option because you assume past terms are fixed. Factors like CapitalPlus have different percentage rates based on different invoice dollar amounts, repeat history with you as a client, and many other circumstances. Factoring rates change… get a new quote before assuming you should not consider factoring.

Real-world Factoring Examples

To provide a clearer understanding of how invoice factoring works in practice, let’s explore some real-world scenarios that our company has had in the past 25+ years. Because these examples are based on actual construction clients, their names have been hidden, but the amazing results are clearly visible.

Example 1: Concrete Contractor — Michael W.

Scenario: Michael was on cloud nine after securing a $1,200,000 contract with the City of Houston. However, his excitement was short-lived. Despite his extensive experience in the concrete industry, his fledgling company lacked established credit. This led to multiple rejections when he sought lines of credit from banks. Michael soon recognized the looming financial challenge if he couldn’t secure substantial upfront funding.

Solution: After contracting CapitalPlus, Michael found that factoring was the ideal solution for his problem, especially since his credit history wouldn’t be a barrier. Through factoring, he quickly received $960,000, helping him purchase the necessary materials for the project within a few days. Once his client settled the invoice 65 days later, he received the remaining 20% (minus the factoring fees).

Example 2: General Contractor — James S.

Scenario: James was really feeling the pinch of slow payments after completing his most recent project at a luxury resort in South Florida. Stressed that he might possibly miss paying his subcontractors, he turned to CapitalPlus for factoring.

Solution: He quickly secured $280,000 of factoring money. In addition, his stress was reduced even more using their complementary internal lien monitoring.

Example 3: Mechanical Electrical and Plumbing Contractor — Joseph L.

Scenario: Joseph needed working capital to purchase over a million dollars of new materials and supplies if he wanted to take on an exciting new project. Because the job did not allow materials to be invoiced at delivery, not having a cash infusion would mean he would have to pass on the opportunity.

Solution: Being a returning client, the funding process was expedited allowing him to get the $2,000,000 in receivables financing the very next day. This was a game-changer for his business allowing him to quickly buy the materials needed for the project.

>>RELATED READING: See more of CapitalPlus’ case studies

Is Invoice Factoring Right for You? A Checklist.

Factoring should be considered a viable option for a small business if:

there is a lag time between you completing a job and getting paid.

your business is new or does not have established credit (but your client does).

you don’t have time to wait on the bank’s slow paperwork processing and decision-making.

you need money but don’t want an option that affects (or potentially hurts) your credit rating.

With any financial solution, factoring companies included, some will be a perfect fit, others won’t. It is our hope that after reading this article you will have a better understanding of invoice factoring, and what to look for in factoring companies so you can choose the best one for your business.

Remember, factoring is NOT for everyone. If you have questions about how factoring might fit within your unique business needs, feel free to reach out at 865-670-2345 or schedule a call.

Learn how CapitalPlus can help your business. Pick your specific construction focus to get started!

About the Author:

Curt Powell — VP of Sales

Joining the team in 2016, Curt serves as the Vice President of Sales at CapitalPlus Financial Services, a direct lender based in Knoxville, Tennessee focusing exclusively on the construction industry. During that time he has walked thousands of business owners through the financing options to find the best solution for their needs.

Curt is a member of The International Factoring Association, The Association of General Contractors, and the Construction Financial Management Association.

CapitalPlus was established in 1998 providing over $1 billion in factoring funds empowering thousands of construction companies all over the US.

Article Sources:

- Wikipedia. “Code of Hammurabi, https://en.wikipedia.org/wiki/Code_of_Hammurabi”

- IBIS World. “Invoice Factoring Industry in the US, https://www.ibisworld.com/industry-statistics/number-of-businesses/invoice-factoring-united-states/”

360iResearch.”Factoring Market by Type, https://www.360iresearch.com/library/intelligence/factoring” - Capstone. “2022 State of the Factoring Industry Report, https://capstonetrade.com/2022-state-of-the-factoring-industry-report/

- Nerdwallet. “Business Loan Requirements: 7 Things You’ll Need to Qualify, https://www.nerdwallet.com/article/small-business/how-to-qualify-for-small-business-loans”

- Construction Financial Management Association. “https://cfma.org/”

- International Factoring Association. “https://www.factoring.org”

- CapitalPlus Resources. “What is a Notice of Assignment and How Does it Protect the Construction Business? https://capitalplus.com/notice-of-assignment-protect-construction/

- Acquisition.gov. “Subpart 32.8 – Assignment of Claims, https://www.acquisition.gov/far/subpart-32.8″