You run a small construction company. Your team has been working tirelessly on the latest project completing it right on schedule. However, despite the hard work, you find yourself in an uncomfortable position. You are having trouble paying your team due to the temporary cash-flow gap – that tough time between the completion of the work and getting paid.

After some research, you determine that invoice factoring looks to be the quickest solution. You need to find a company to work with. But will they work with a business like yours? If they do, what questions do you need to ask them? What questions do you not even know to ask? Who can you trust? We will be answering these and many other common questions people need to know when assessing and picking the best factoring company for their business.

CONTENTS:

— What is a Factoring Company? How Do They Work?

— When Would a Business Benefit Most Using Factoring?

— Why Do Businesses Use Factoring Companies?

— What Industries Do Factoring Companies Serve?

— What Are the Disadvantages of Using a Factoring Company?

— How Does A Factoring Company Make Money?

— What Are the Other Fees and Costs?

— How is A Factoring Company Different From A Bank/Traditional Lender?

— Do You Need Good Credit for a Factoring Company?

— What Documents Do Factoring Companies Need?

— What Is A Factoring Agent?

— Can I Have Two Factoring Companies?

— Do Factoring Companies Report to Credit Bureaus?

— Are Factoring Companies Legal?

— Are Factoring Companies Regulated and Licensed?

— Is Factoring Income Taxable? Can You Write Off Factoring Fees?

— Do Factoring Companies Send Out a 1099?

— What Do I Need to Know to Pick the Right Factoring Company?

— What Other Services Are Offered by Factoring Companies?

— Who Is the Best Factoring Company for MY Business?

— How Do I Know I Can Trust A Factoring Company?

— Is It Important to Use a Large Factoring Company?

— Examples of How Fit Helps Businesses

What is a Factoring Company? How Do They Work?

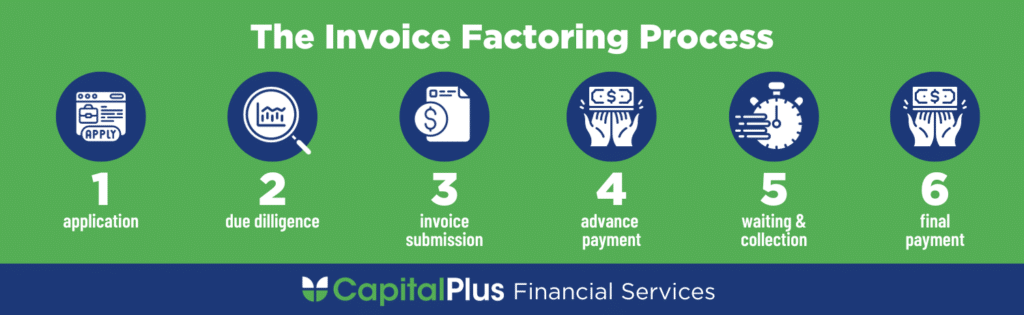

Before diving into specifics of factoring, let’s be clear about what a factoring company is and what they do. A factoring company, or “Factor”, provides a financing solution that pays a business for one or multiple outstanding invoices (accounts receivable) at a discounted rate. Here’s a common timeline of the process:

- Application: The business applies to become a client.

- Due Diligence: The factoring company’s underwriting does a few checks. Typical examples are proof of business licenses and insurance, assessment of the creditworthiness of the invoiced customer, and timeliness of past payments. If all looks good, the business becomes an official client.

- Invoice Submission: The business submits its unpaid invoices to the factoring company.

- Advance Payment: A portion of the invoice amount, typically around 70-90%, is sent to the business usually within a day or two.

- Waiting and Collection: The factoring company collects the payments directly from the customer.

- Final Payment: The remaining 10-30% balance is then sent back to the business, minus the factoring fee(s).

When Would A Business Benefit Most from Factoring?

Though businesses of any size or age can use factoring, typical businesses that most often benefit from factoring fall within these general categories:

- Startups: These businesses have not yet built the long-term credit history that banks require.

- Small and Medium-Sized Enterprises (SMEs): It is often much tougher to get traditional lending when you’re small.

- Businesses with Irregular or Seasonal Revenue Streams: The lack of predictable cash flow scares banks, but fits within a factoring company’s model.

- Companies Experiencing Rapid Growth: Not being able to keep up with payments due to growth can be helped by factoring.

Why Do Businesses Use Factoring Companies?

The are many compelling reasons businesses turn to factoring companies for cash:

- Cash Flow Support: Factoring companies provide almost immediate access to cash, improving liquidity for day-to-day operations.

- Stopgap Working Capital: It allows businesses to reinvest in growth, pay suppliers, purchase materials and inventory, and cover operating expenses.

- No Debt Funding: Unlike loans, factoring doesn’t show up as debt on the business’s balance sheet.

- Credit Risk Mitigation: Factoring companies help shoulder the risk in the event of customer non-payment.

- Faster funding: Receiving factoring money from factoring companies is faster than from traditional financing outlets (as little as 12-24 hours after becoming a client.)

- Easier Approval: With less stringent requirements and fewer checks, acceptance as a client by factoring companies is much easier than by banks.

What Industries Do Factoring Companies Serve?

Factoring companies cater to a wide range of industries. Typically in the services and manufacturing trades, these businesses include but are not limited to:

- Construction companies

- Trucking and Freight companies

- Manufacturing businesses

- Staffing and Recruitment industries

- Healthcare

- IT Services

- Wholesale and Distribution industries

- Oil and Gas companies

- Textiles and Apparel businesses

- Government Contract Suppliers

- and many other businesses that have long billing cycles and extended repayment terms after the job’s completion.

What Are Some Disadvantages of Using a Factoring Company?

While factoring offers numerous advantages, it’s smart to be aware of the potential drawbacks. A few to take into consideration are:

- Cost: Factoring companies charge higher rates as compared to banks or other traditional financing.

- Business Suitability: Factoring may not be ideal for very low-profit margin businesses.

- Factor/Business Relationships: If not clearly communicated with their clients, businesses could introduce “awkward” customer relationships when the factoring company takes over an invoice.

How Does a Factoring Company Make Money?

As with any business, factoring companies need to make money to survive. They do this by charging fees, most often as a percentage of the factored invoice amount. The standard flat rate usually runs between 2 and 6 percent, but some factoring companies have a sliding fee scale that depends on such factors as the invoice’s dollar amount, the business’s industry, or the creditworthiness of their customers.

What Are the Other Fees, Charges, and Penalties?

Though not all, some companies will add additional fees on top of the standard factoring percentage fee. These would include:

- Application or Discount fees: an upfront fee for starting the factoring process.

- Service fees: a monthly or weekly fee used for managing collections and credit checks.

- Closing fees: a monthly or weekly fee used for miscellaneous, company-determined usages.

- ACH or Wire Transfer fees: a fee for electronically transferring money between bank accounts.

- Monthly minimum fees: a fee added to make up the difference when a business has committed to a certain number of monthly invoices but does not meet the agreed-upon minimum.

- Termination fees: a penalty fee for when a business has committed to a certain number of monthly invoices but terminates the contract early.

You might see some, all, or none of these fees added to your basic factoring fee. However, there should never be any “hidden fees”. Factors should be very clear about all these charges by disclosing each one well in advance of you both entering into any agreements.

How is a Factoring Company Different from a Bank or Other Traditional Lender?

Banks and factoring companies are very different primarily because factoring is a completely different financial concept than a bank loan. The most obvious differences (advantages) that factoring has are:

- Collateral: Factoring uses the dollar amount of the accounts receivable invoice as its collateral.

- Speed: Factoring approvals and funding are faster because there are fewer in-depth checks compared to a bank’s.

- No Debt: Because the invoice is sold, factoring doesn’t add debt to the company’s balance sheet.

- Credit Approval: The factoring company’s approval is based on the creditworthiness of the invoiced customers, not necessarily the borrower.

Please note that banks and factoring are not always 100% exclusive. There are a few banks that also offer factoring in addition to their traditional financial services.

>> RELATED READING: Factoring vs. Bank Loans — A Head-to-Head Comparison

Do You Need Good Credit for a Factoring Company?

While your business’s credit is essential when applying for traditional bank loans or lines of credit, factoring companies focus primarily on the creditworthiness of your client. If they have a history of paying invoices reliably, it greatly increases your chances of approval.

Keep in mind that some factoring companies do add a credit check on the business applying for factoring money as part of the initial assessment. Although not usually about creditworthiness, this check is used to determine the general “health” of the company in the hopes of minimizing future issues.

What Documents Do Factoring Companies Need?

Because not all factoring companies are the same, their paperwork requests will also differ. But here is a general idea of what you might be asked to send when starting work with a factoring company:

The “pre-client” assessment paperwork might include:

- Basic Personal ID

- Business Licenses, Articles of Incorporation, Tax ID Number, or other documents that prove that you are a business

- Proof of Insurances

- Balance Sheets

- P&Ls

These documents help give factoring companies an overall indication of the business’s health and past work history. After all, the last thing the factoring company wants to see is you consistently not completing work or not delivering products. These things would keep the Factor from being paid on the invoice they purchased.

As part of the “trust building” assessment, some factoring companies might ask for other documents such as past tax returns (you and/or your company),

Factoring Application paperwork might include:

- An Accounts Receivable/Payable Aging Report

- Invoices: Copies of the invoices you want to factor

- Proof of Delivery: Proof that the products or services have been delivered

- Client Information: Documents about the company responsible for paying the invoices

- Primary contact information

- Company information (for credit check)

Of course, all factoring companies are different and may request additional (or fewer documents) based on their specific requirements.

What is a Factoring Agent?

Also referred to as a factoring broker, a factoring agent is a professional who connects businesses with factoring companies. They help businesses find the best factoring company for their specific requirements. These agents often have extensive knowledge of the factoring industry and know the unique benefits of different factoring companies. The legwork of narrowing down choices can help streamline the overall process.

Factoring agents are usually paid by the factoring company, not the client, and their rate is typically a flat fee or percent of the overall factoring fee.

Can I Have Two Factoring Companies?

While it’s possible to work with multiple factoring companies simultaneously, it can become confusing and will involve coordination to prevent double financing of the same invoices. If you want to work with multiple factoring companies, be sure to communicate with both in advance. Spot factoring, factoring single invoices rather than a complete book of invoices, will help keep things less complicated if this is something you are trying to accomplish.

It is worth noting that most factoring companies will not work with you if they know are currently with another company at the same time for the reasons mentioned above.

Do Factoring Companies Report to Credit Bureaus?

No, not usually. This is because they make their determination to offer factoring based on your customer’s creditworthiness, not your business’s. So, unless they do a hard pull of your credit as part of their onboarding process, factoring generally doesn’t impact your business’s credit score.

Are Factoring Companies Legal?

Yes, most factoring companies are legal entities that provide a legitimate financial service: factoring. But as with any industry, there have been companies that have used questionable, even illegal tactics. Rest assured, these companies are quickly spotted and stopped.

Are Factoring Companies Regulated? Are They Licensed?

Because they are not lending money factoring companies are not held to the same regulations as traditional lenders. However, they may still need to comply with specific state and federal laws related to finance and debt collection. And, when they are licensed, it helps ensure legal compliance and of course ethical practices.

Is Factoring Income Taxable? Can You Write Off Factoring Fees?

The income received from factoring is generally considered taxable for your business. However, you can typically deduct factoring fees as a business expense. It’s best to talk with your financial advisor or tax professional for details specific to your state.

Do Factoring Companies Send Out a 1099?

In the United States, factoring companies are not required to issue Form 1099 to businesses. It is a good idea to add this question to the list of questions you ask when assessing companies. If you are working with a Factor that doesn’t send them, it is even more important than ever to keep accurate records of all factored income for tax purposes.

>> RELATED READING: Taxes and Factoring – What You Need to Know

What Do I Need to Know to Pick the Right Factoring Company?

According to industry researcher IbisWorld, there are currently 314 factoring companies in the US. With all these unique choices, trying to pick the best factoring company for your business can be tough. Keep the following questions in mind when assessing:

- Reputation: Do they have favorable online reviews and a positive Better Business Bureau rating?

- Experience: How long has the factoring company been offering factoring? Do they have years of experience or are they still learning the factoring business?

- Industry Experience: Does the factoring company have expertise in your unique industry? And if so, how long?

- Customer Service: Do they have high-quality customer support? Was your call quickly answered by a real person or did you have to go through layers of automation? Did your contact clearly explain how factoring works, and its pros and cons as it relates to your situation?

- Rates and Fees: Was their fee structure clearly explained and easy to understand?

- Contract Terms: Were their terms and conditions clearly stated in the agreement?

- Additional Services: Do they offer other support services besides factoring?

What Other Services Are Offered by Factoring Companies?

In addition to invoice factoring, some factoring companies offer related services especially when the company focuses financing to specific industries. Some examples include:

- Purchase Order Financing: Funding to cover the cost of fulfilling large orders.

- Asset-Based Lending: Securing a loan against assets like inventory or equipment.

- Credit Insurance: Protection against non-payminsent by customers.

- Lien Monitoring: Assessment and monitoring of lien rights associated with the company.

So, Who is the Best Factoring Company?

The better question to ask is “Who is the best factoring company FOR MY BUSINESS?” Determining the best factoring company depends on your specific business needs, the invoice dollar amount, and the creditworthiness of your client.

In addition to those, another consideration is working with factoring companies that focus on specific industries vs. “one size fits all” companies. Focusing can allow them to better tailor or offer additional, industry-specific services. For instance, a construction-specific Factor might suggest an additional service like Material Financing (the pre-purchasing of raw materials) as an addition to, or even as an alternative to, factoring. Only by being in the industry would they fully understand that problems like material purchases are a major contributing factor to a construction company’s cash flow issues.

How Do I Know I Can Trust The Factoring Company?

You’ve researched and found many companies. You have an idea of their fees and list of add-on services. But the nagging thought might center around one basic question: “How do I know if the factoring company is trustworthy?” While there is no single indicator of trustworthiness, many small clues can help you gauge. Start by visiting a factoring company’s Better Business Bureau page. It should quickly give you an idea if this is a company you should be working with.

Being a member of industry and trade associations is another good indicator of current viability. The company will need to be in good standing to be allowed to be part of these groups.

Length of time in business can be another indicator. After all, if the factoring company was not trustworthy, it wouldn’t have been around for 2, 4, or even 25 years.

Of course, you can always ask around. Word-of-mouth is always a good indicator. Reading the reviews, like on their Google profile, should quickly give you an idea of how they treated their customers in the past.

You might be tempted to take the word of 3rd party websites’ “top/best factoring companies” lists. Keep in mind that not all these sites are impartial — getting on their list might be a paid position, so don’t base your whole decision on them.

I Can’t Decide. Should I Just Pick the Largest Factoring Company?

Today, being a larger factoring company does not necessarily offer advantages like it did in the past. Larger firms might offer larger funding amounts, while smaller ones focus on specialized knowledge, personalized service, and industry-focused advantages. Fit, not size should be your number one deciding factor.

Proof That Good “Fit” with a Factoring Company Benefits the Business

Because much of this article talks in generalities, it is helpful to illustrate using real-world examples. Of course, we can’t talk from other factoring companies, but can give examples of success stories from the 25 years we’ve been offering invoice factoring – how working with a factoring company that is a perfect fit, can really take off the financial handcuffs of a business.

Example 1: Subcontractor Lost This Established Funding

A masonry and concrete subcontractor from Atlanta, GA came to us when his funding dried up. The bank he consistently used decided that funding the construction industry was simply “too risky” and dropped the account. This left him unable to pay for his materials bill. Working with a factoring company that specializes in construction financing, meant he was not only able to pay for the materials for this project but also would not lose future funding due to his industry.

Example 2: Company Needing an Out-of-state Equipment Lease

This Excavation company took on a project by an out-of-state client and needed to lease equipment locally. Because the local leasing firm did not have any history with our client, they wanted payment upon delivery. CapitalPlus provided the leasing firm with assurance of payment, allowing the leasing company to provide 45-day terms. We quickly funded each monthly invoice and directly paid off the equipment lease totaling $92,000.

Example 3: A Contractor’s Lack of Established Credit

This Florida-based concrete contractor had an opportunity to take on a large contract and needed working capital. However, even with decades of experience as a business owner, banks were unwilling to offer him a business line of credit because his new company had only been in business for less than a year. CapitalPlus conducted due diligence, became comfortable with their debtor, and offered them $1,400,000 in factoring funds.

In conclusion…

When looking for the best factoring company, knowledge is your most valuable tool. This comprehensive guide offers you an insider’s look into how factoring works, its benefits, and how to assess a provider that best fits your construction business’s needs. Don’t let cash flow challenges slow you down. Reach out to our experts now for a personalized consultation and take the first step towards financial flexibility and growth.

Learn how CapitalPlus can help your business. Pick your specific construction focus to get started!

About the Author:

Curt Powell — VP of Sales

Joining the team in 2016, Curt serves as the Vice President of Sales at CapitalPlus Financial Services, a direct lender based in Knoxville, Tennessee focusing exclusively on the construction industry. During that time he has walked thousands of business owners through the financing options to find the best solution for their needs.

Curt is a member of The International Factoring Association, The Association of General Contractors, and the Construction Financial Management Association.

CapitalPlus was established in 1998 providing over $1 billion in factoring funds empowering thousands of construction companies all over the US.

Back to blog