When you’re looking to grow your construction business, quick and easy access to cash flow can make all the difference in keeping your business running smoothly. That’s where a trustworthy factoring company comes in. Knowing you’re working with a reputable company brings needed peace of mind, allowing you to focus on running and growing your business. This peace of mind comes from knowing that your factoring company is reliable delivering the promised funding according to the agreed-upon schedule. You can also be confident there will be no surprises in costs. So, with so many factoring companies out there, how can you be sure you’re choosing one you can rely on? This article will discuss five key factors to consider when assessing a factoring company’s trustworthiness.

While there is no single indicator of trustworthiness, many clues can help you determine if the company is on you can rely on.

Signs a Factoring Company is Trustworthy:

- have favorable customer reviews

- are transparent with their charges

- have long-term, industry-specific knowledge

- they have outstanding customer-service

- received awards, accreditations, and affiliations

1. Positive Company Reviews and Reputation

When assessing factoring companies look for ones with high ratings and positive reviews from other construction businesses. The number one place to start might be the simplest — word-of-mouth. Asking others in your industry who they would recommend is a good starting point. If they have used a Factor, they are usually happy to share their experience, recommending good ones and warning of bad ones. And even if they have not factored before, they often hear from those that have.

If you are looking for digital confirmation of a factoring company’s trustworthiness, there are a few online sources to check. Google Reviews (in their business profile), the Better Business Bureau, and even social media profiles will often have customer reviews displayed. For example, we here at CapitalPlus are proud of the fact we have had a perfect Better Business Bureau (BBB) rating since we started in 1998.

Keep in mind that looking at a factoring company’s reviews can give you a skewed picture of their reputation. In search engines reviews like Google Business Profile, it is difficult if not impossible to remove reviews. So you will quickly know if the company has serious issues if they have many negative ratings. But at the same time, a few disparaging ones should be expected. People can be slow to praise and quick to criticize. So read both the negative and positive reviews to get an idea if the problem was really a problem.

You might look at a 3rd party website’s “top/best factoring companies” list. Watch for disclosures indicating their impartiality — getting on their list might be as simple as paying for the promotion. So include a factoring company’s ratings in your list as an indicator, not a sole determiner.

2. Transparency of Terms and Fees

From the first communication with the prospective factoring company, you should be clear on their system — how factoring works in for your business, what they expect from you and your client, and any fees or charges. Undisclosed fees or unclear terms could cost you more in the long run. We pride ourselves on clarity from the moment we first talk in the initial intro call. Our terms are designed to be easy to understand, ensuring you know exactly what you’re agreeing to — straightforward terms without hidden fees.

3. Industry Focus and Experience

We are all aware, there are many choices for factoring companies available to you. Some are large, some small. Some industry-focused, some non-specific. While all these options have their pros and cons, we believe that there are advantages to working with a smaller, construction-specific factoring company. Being specific to a single trade means you will be working with a team that has repeatedly seen the struggles you face and specifically designed their factoring solution to solve them. Who would you prefer to work with: a company with arbitrary rules that apply to everyone or one that knows the typical payment schedules of the construction industry, for example?

The length of time in business can be another good indicator. After all, if the factoring company isn’t trustworthy, it wouldn’t have been around for 1, 2, or even 25 years.

4. Customer Service

When assessing a potential business relationship, from restaurants to financial services like factoring, great customer service can make a significant difference in your long-term satisfaction. Responsive and supportive customer service helps address any concerns quickly and efficiently. Being able to quickly speak to a person on the phone if you have questions should be a standard (but sadly isn’t in today’s automated, AI world).

5. Industry Accreditations and Affiliations

Being a member of industry and trade associations is another good indicator of a trustworthy factoring company. While most of these groups require membership fees, the factoring company will need to maintain good standing to stay in the group.

These memberships can also communicate the factor’s commitment in furthering education within their field, which will translate to a better product for you.

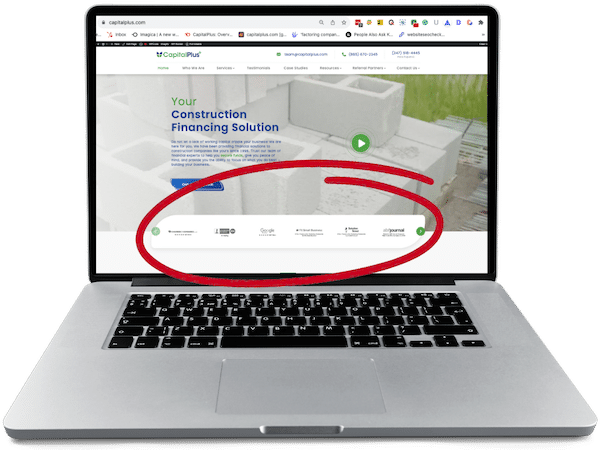

Industry awards are always good to see. The company’s awards and industry affiliations are often prominently displayed on its website.

Many trade associations will take it a step farther and occasionally reward the companies with outstanding attributes. Because these are such big deals, the factoring company will proudly display the accolade (along with other testimonials) proximately on their website.

Next Steps…

In selecting a trustworthy factoring company, you will need to consider everything — their reputation, transparency, focus, customer service, and industry affiliations. By focusing on these criteria, you can confidently select a reliable partner to support your construction business’s growth and stability. Ready to take the next step? Talk with our experts today to discuss your specific needs.